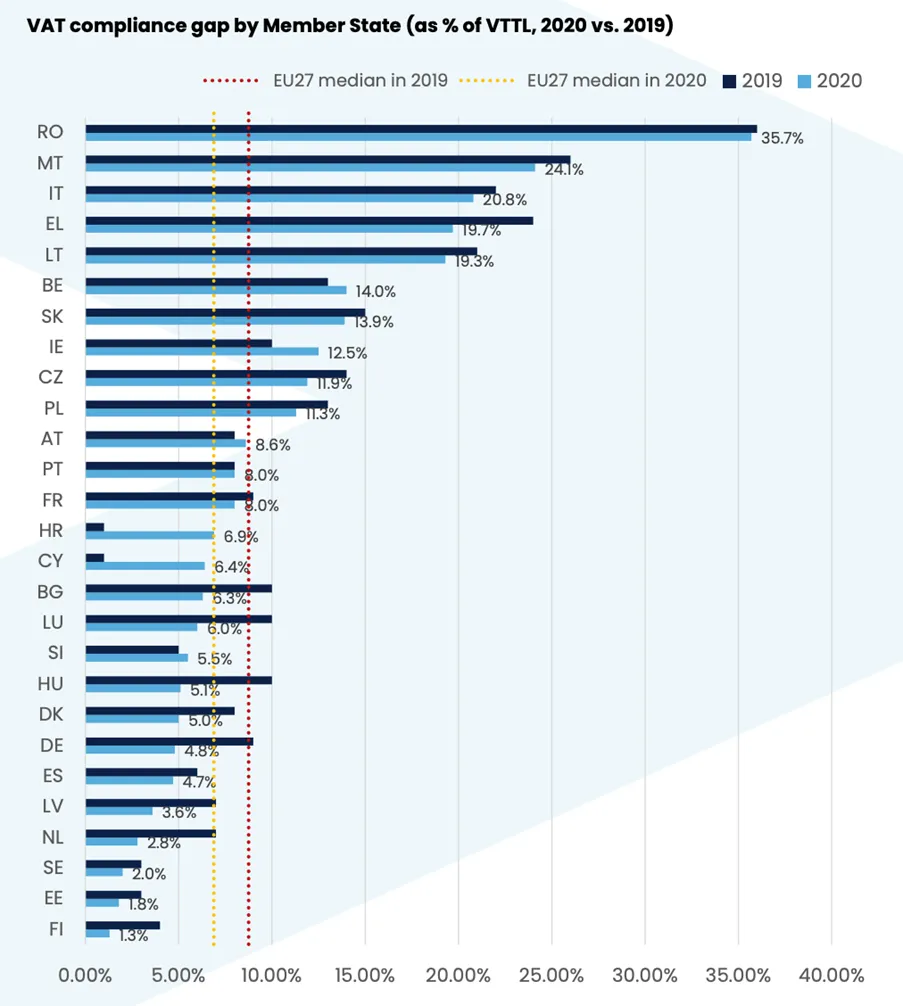

ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile

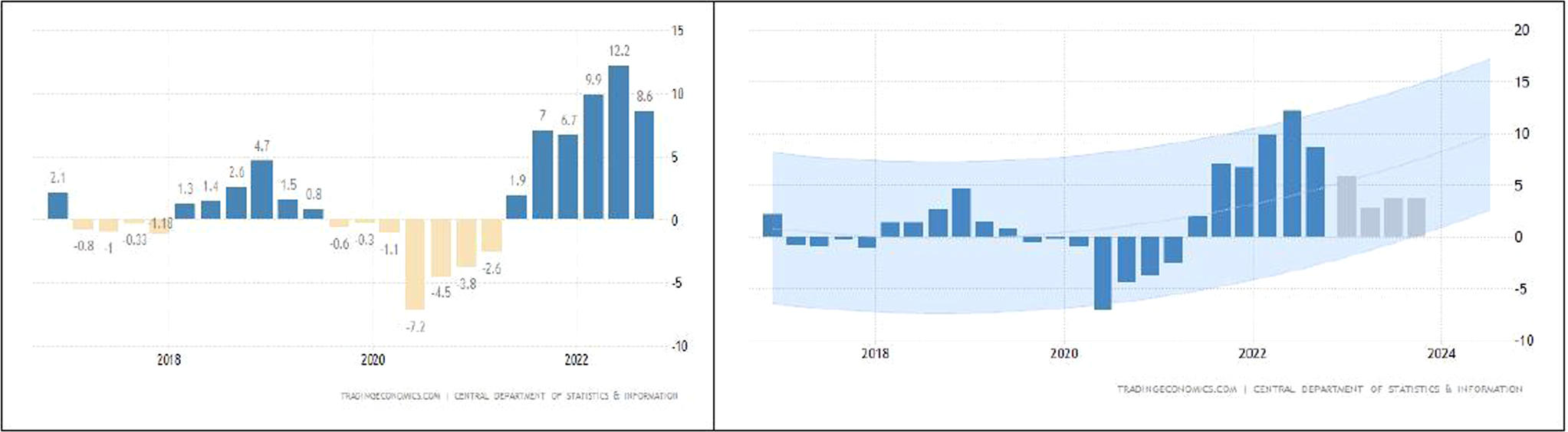

Economies | Free Full-Text | Formation of a Sustainable Mechanism of Preferential VAT Taxation of Exports as Evidenced by the Russian Federation Practice

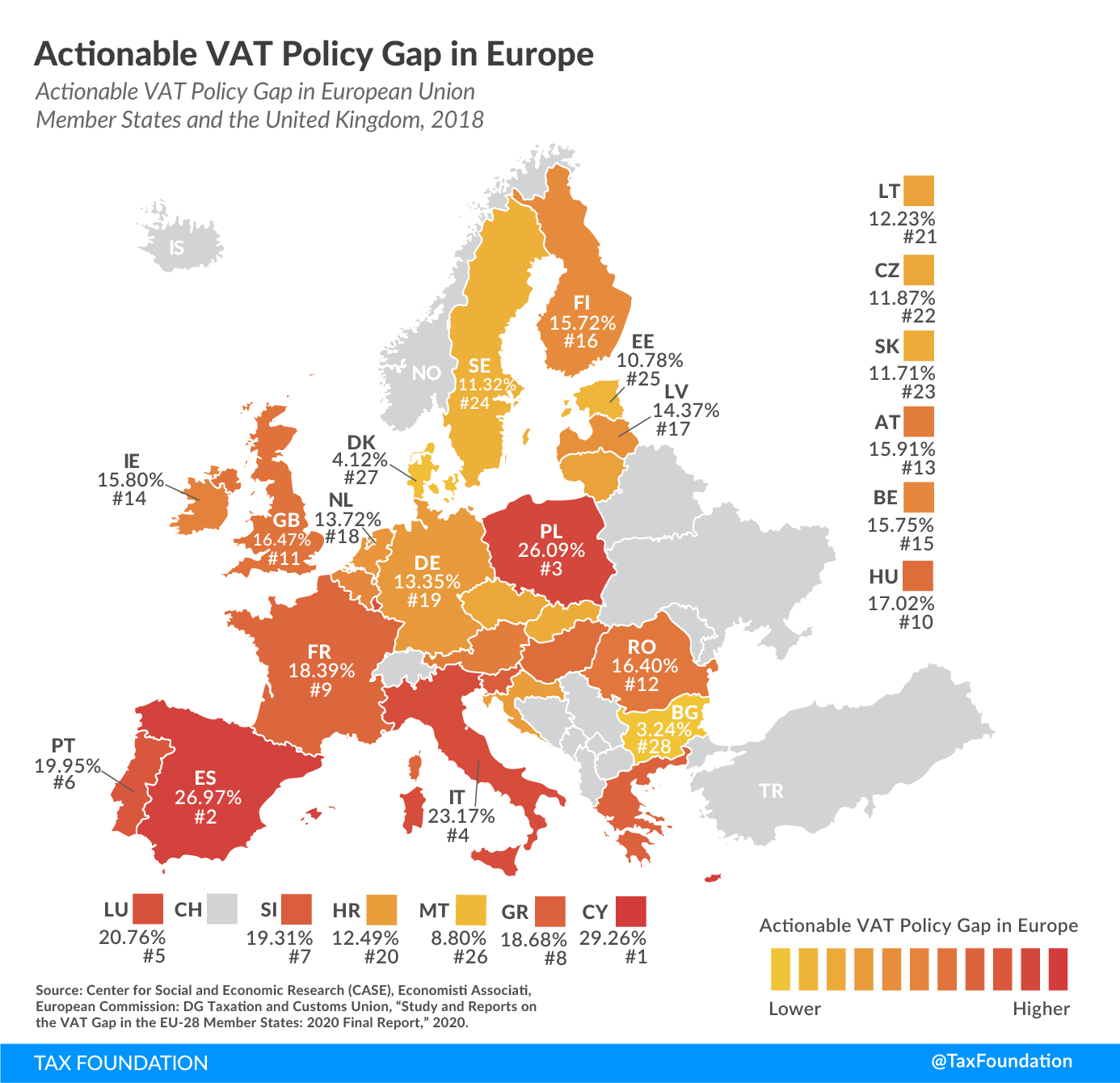

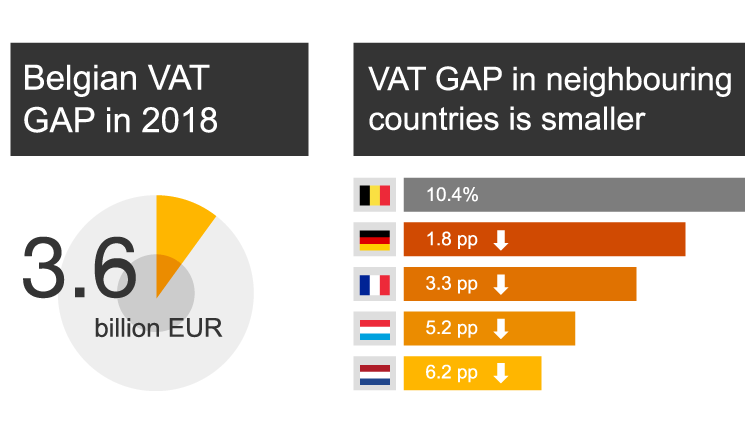

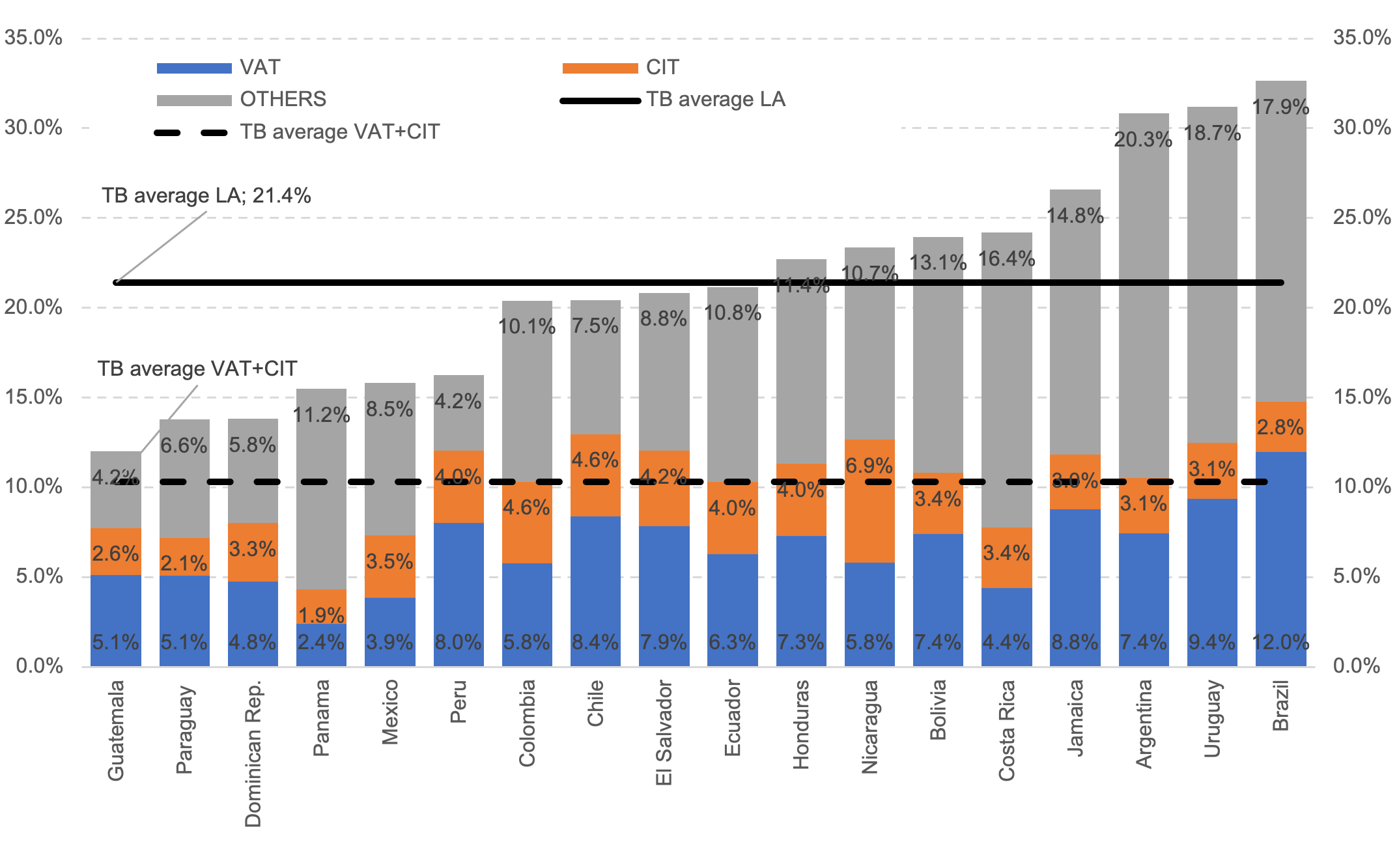

Revenue Efficiency of Value Added Tax and Corporate Income Tax | Inter-American Center of Tax Administrations