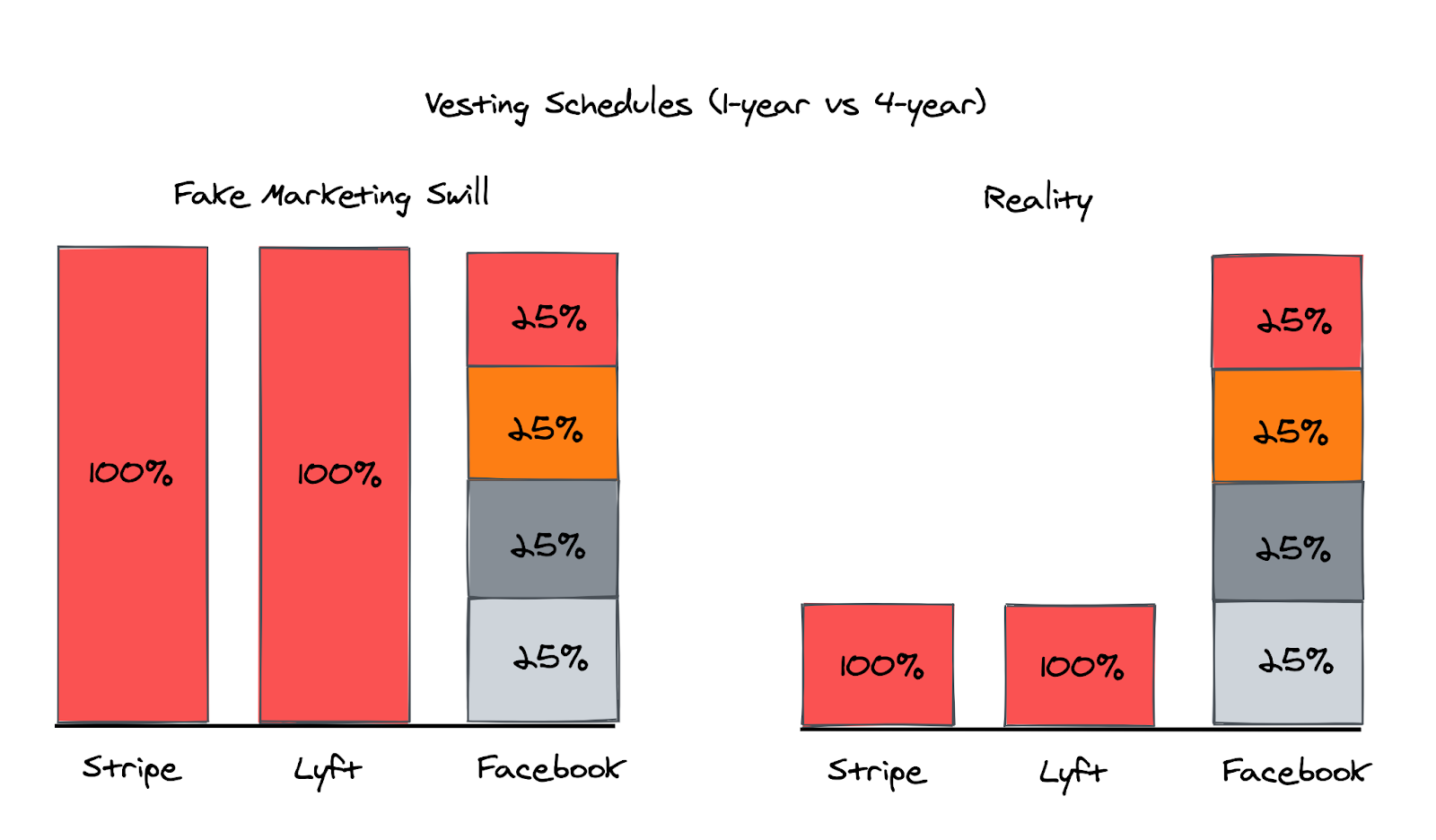

Should you ask for equity 📈?. Quick guidebook to figure out how much… | by Augustin Sayer | Entrepreneurial Resolutions | Medium

Do I Understand this Term Sheet? — Part 3: Vesting and Its Implications on the Acquisition Offer | by Darshita Chaturvedi | Startup Stash

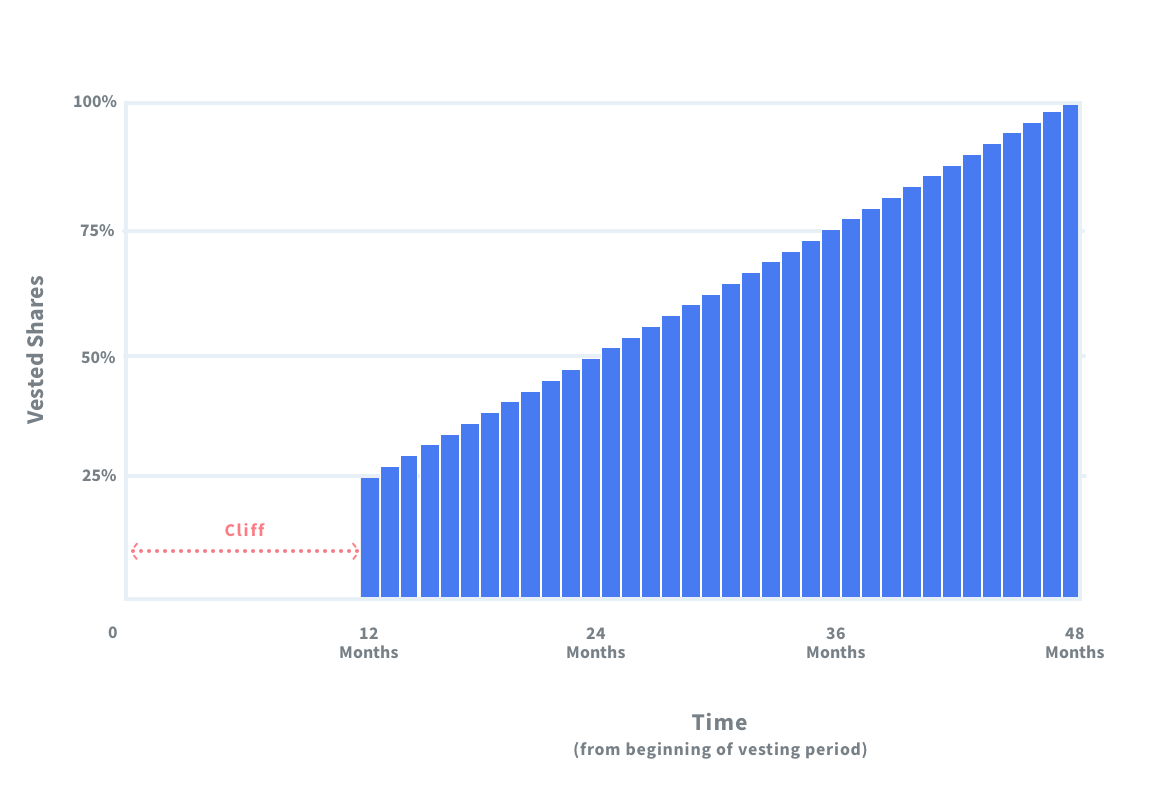

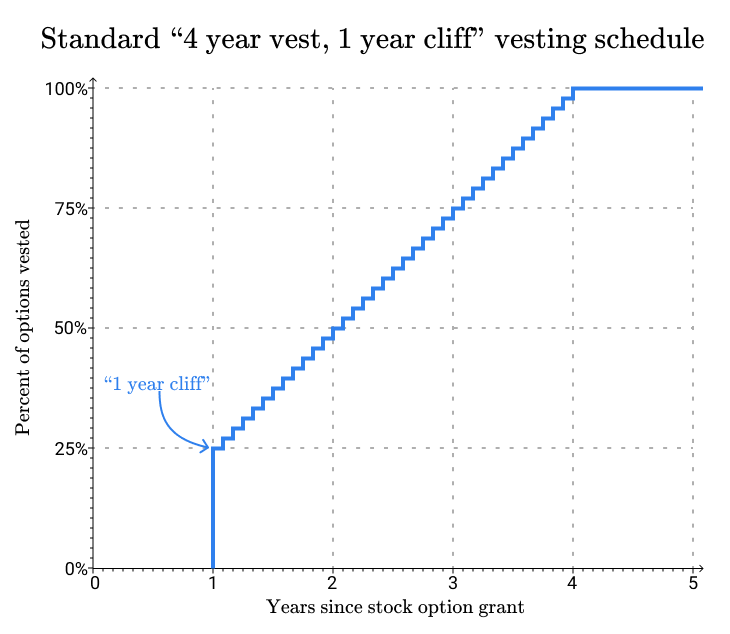

With start-up options a typical term is 4 years, with a one year cliff and accelerated vesting. Is it normal for accelerated vesting to be triggered at any time? Eg. if the

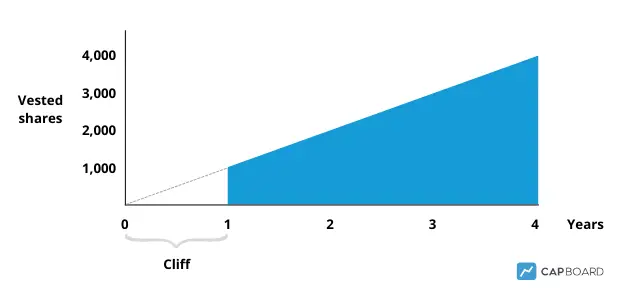

Gergely Orosz on Twitter: "2. Vesting, cliffs, refreshers, and sign-on clawbacks. If you get awarded equity, you'll want to understand vesting and cliffs. A 1-year cliff is pretty common in most places

Is four-year vesting with a one-year cliff still a fair, effective way to offer equity to cofounders and employees in a startup? - Quora

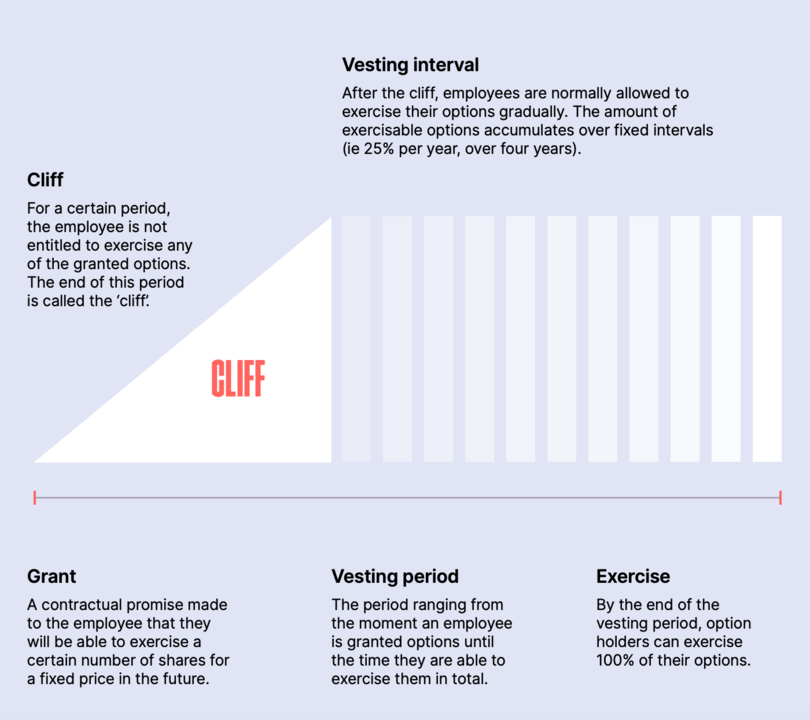

![Quotabook │ Blog - [QuotaWiki] What is an Employee Stock Option Plan? Quotabook │ Blog - [QuotaWiki] What is an Employee Stock Option Plan?](https://assets-global.website-files.com/618a0db0508e1aad124061f4/623d6ebdfcc001a1f60db042_ESOP%20vesting-graph%20(1).png)